Formula One Group: Cash Is King (NASDAQ:FWONA)

bwzenith/iStock Editorial via Getty Images

Investment Thesis

We’re seeing the fruits of Liberty’s transformation of the Formula One Group (FWONA). The company is set up nicely to see a significant acceleration in 2022. Its valuation seems fair to expensive on most metrics but cheap on the metric that counts. Formula One Group is a true cash cow with an excellent yield. I expect the value given to FCF yields to increase in the current QT environment and investors to flock to high-yielding assets like the Formula One Group. Cash flows also have the added benefit of shareholder returns and Formula One Group could buy up to a third of its market cap while also paying down its debt. I’m a buyer of Formula One Group stock at today’s prices.

Formula 1 Changing for the Better for All Stakeholders

Formula One Group went through a transition under Liberty ownership. Liberty made a lot of improvements in increasing the commercialization of the sport as well as increasing its fan appeal through competitiveness. Changes were made to both the financial and technical aspects of Formula 1.

I want to talk about the flywheel that is F1 before touching on some specific changes Liberty made which I think will drive long-term value for the stock. In F1, developments tend to spark a positive feedback loop. An action improving any of the underlying factors within racing, fans, teams, race promoters, sponsors and broadcasters tends to improve value for all parts of F1. Better racing, for example, will result in more fan engagement, which will grow the revenue pie and get race promoters, sponsors, and broadcasters to spend more. Higher revenues will increase F1’s value for teams which will increase competitiveness and likely lead to even better racing. A catalyst affecting any part of the flywheel will have an effect mirroring this positive feedback loop.

We’ve seen this flywheel in play when the sport was transformed in the Ecclestonian era and I believe that we’re about to see another revolution with Liberty at the helm. Liberty seems to understand this flywheel perfectly and is undertaking key changes to drive value for all stakeholders.

First up is the core of the sport, racing itself. F1 had proposed new rules for the 2021 season which were delayed to 2022 due to the pandemic. These rules have increasing overtaking at the heart with key aerodynamics changes to cars, which will decrease drag which slows down cars behind. For the non-fans out there, overtaking is the most enjoyable aspect of motor racing. All the excitement happens when cars compete side to side and are forced off of the ideal racing line. These new changes should play an important role in increasing fan engagement.

Perhaps more important than on-circuit changes are the financial ones. Fans often complain that the cars are more important than the driver in today’s racing and that they’d rather see drivers race instead of the machines. F1 will tackle this by setting spending caps. Spending caps will level the playing field among teams and should make the cars more equal and lead to better racing. They will also make the sport more financially attractive for teams which should lead to more demand for a racing slot. An Audi/Porsche team is already in the talks.

A second financial change was to the division of the sport’s revenues. The new structure will give more revenue visibility to the teams and yield better margins for Formula One if the sport grows. The new structure will entail prize fund tiering where the percentage of payment teams receive decreases as the prize fund increases. Specifically, teams are to receive 70% of the first $1.25 bn OIBDA, but 60% of the next $250 mn, and 50% thereafter. This structure will also enable significantly better long-term margins for Formula One if the sport grows, which is certainly my base case.

Perhaps the most important thing Liberty has done is create an online presence for the sport. F1 had little digital presence when Liberty took over thanks to Bernie’s dismissal of social media as short-lived. Drivers weren’t allowed to be on social media. Liberty changed this. The online channel is very important in terms of widening reach and increasing engagement. F1 has dramatically increased its use of social media to attract millions of followers. The company’s Netflix (NFLX) partnership was even more important. F1’s Netflix series, Drive to Survive, delivered the sport to millions with a focus on Millennials and Gen-Z. This new marketing approach is fueling future growth.

We’re seeing the fruits of Liberty’s labor in record viewership figures for the past season. I expect these numbers to secularly increase over the coming years. 2022 is a particularly great setup for the company with easy comps. We’ve seen 17 races in the past season with 23 scheduled for the next including a long-awaited Miami GP. This longer race schedule, along with the finish to the last season which may arguably be described as the most exciting end to any sporting competition, should bring record demand for next season.

Massive Opportunity in New Markets

International viewership was among Liberty’s main goals. F1 has historically been stereotyped as a sport for rich Europeans. Carrying the sport to mass international is where the heart of the potential value lies. The US is the most important market with a large and rich potential fan base.

Liberty had this at heart and brought the sport to the US physically as well. Last season had a GP in Austin which was a big success as it attracted 400K fans, 70% of which were attending their first GP. The Miami GP next season is widely looked forward to among F1 fans. The tickets for the event sold out in the first 40 minutes of the pre-sale. The demand in the US is real and the interest for GP’s augurs future interest for TV viewership.

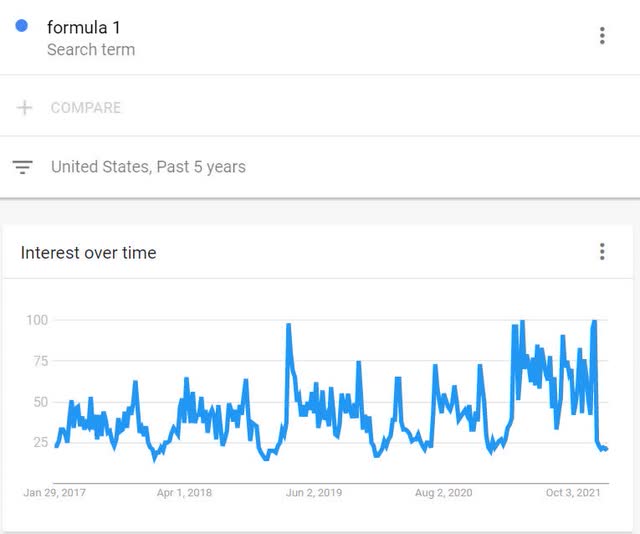

This is reflected in Google Trends as well. The chart below shows the rising cyclical interest in Formula 1 in the US over the past 5 years. While there’s little interest in the sport off-season and lower interest mid-season, the early and late season peaks have been increasing consistently.

Google Trends

The sport’s success in the US would provide a huge upside all around. The flywheel would come into play with a large US fanbase and increase sponsorship, broadcasting, and race promotion revenue everywhere and even increase the value of the sport for teams.

The Attractiveness of the Business Model is Reflected in Company Financials

Formula One has a very attractive business model. It has good revenue visibility with a high ratio of contracted revenues (~80%) and it isn’t involved in the capital-intensive parts of the business like racing or facilitating the racing. These characteristics are manifested in its attractive margin profile of >30% gross and >22% EBITDA margins expected for 2022. But Formula One’s party piece is its cash generativeness. It converts more than 80% of its EBITDA into free cash flow, giving the company an excellent cash yield.

I believe that the cash flow of Formula One will be a key advantage over the coming years. Many investors miss the company’s cash generation for its EBITDA and net income and don’t understand the value created. I expect the current environment of rising rates to renew focus on cash flows and be secularly bullish for Formula One.

Valuation is Undemanding

It’s difficult to find a peer group to compare multiples for Formula One. Its favorable model and growth prospects make it unique. So I believe it’s best to analyze the company standalone.

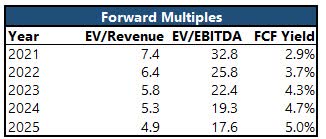

Consensus expects Formula One to grow into its multiples over time. The absolute revenue and EBITDA multiples are high at >7x and ~33x respectively today, but are expected to quickly compress.

Capital IQ, Author Analysis

But I think that this is a case where it’s best to focus on FCF. EBITDA is only used as a proxy for FCF. It resembles FCF without the non-operational disturbances. This approach, however, isn’t right here as it misses Formula One’s excellent cash conversion. I believe that FCF generation is a better gauge of company value.

While the company seems somewhat expensive on an EBITDA basis, it offers an excellent cash yield, expected to approach 4% next year. I expect the stock to rerate with my expectation of growing investor preference for free cash flow in the tightening financial condition environment of the day.

I’m a buyer of Formula One as I see it as a long-term hold and as a play on the international growth and commercialization of the sport, expecting a near-term boost with a renewed market focus on free cash flow.

The Return of Buybacks Could Catalyze the Stock

I think that buybacks could be a key catalyst for the stock. The company purchased ~600K of its shares throughout the first 9 months of 2021 but the potential is much more. We know that Formula One’s leverage target is 5-5.5x net debt to EBITDA. It’s comfortably below this level currently and is generating swathes of cash. It will be looking to return capital to shareholders.

How much capital can be returned is the key question here and I’ve provided the table below to answer the question. The answer is a lot! I’ve provided the current consensus estimates in the top third of the chart. Formula One will run a net cash position in three years if FCF is added directly to company bank accounts and if the company achieves or exceeds consensus expectations.

On the middle third of the chart, I’ve provided a scenario where all excess cash up to hitting the leverage target is returned to shareholders. This yields >$2.46 bn of buybacks until the end of 2022 and >$15.3 bn in the next four years.

On the bottom third of the chart, I’ve provided a more realistic buyback scenario where the company deleverages along with buybacks. In this scenario, the net debt to EBITDA ratio reduces by roughly one turn per year. And even in this case, Formula One can buy back a bit less than $1 bn of its stock by the end of 2022 and buy a total of $4.3 bn of shares in the next four years.

Capital IQ, Author Analysis

These returns would have a very significant effect given the ~$13 bn market capitalization of the company. Buybacks are a reason for owning Formula One in and of themselves!

Comments are closed.